Which Cryptos Are Set to Boom? A Look at XRP, Solana & Compound in 2025

In the constantly shifting crypto landscape, some assets stand out—not just because of hype, but because of real-world utility, community, and scalability. Whether you’re a developer building the next killer dApp or an investor seeking long-term value, identifying the right projects early can be game-changing.

In this post, we’ll look at three high-potential projects—XRP, Solana, and Compound—and explore what makes them tick, and how NoLimitNodes is enabling builders to tap into their full potential.

⚡ Solana: Speed Meets Real Utility

Solana isn’t just another high-speed chain—it’s the heartbeat of real-world dApp development across NFTs, DeFi, and DePIN. With low transaction fees, parallel processing, and growing institutional interest, Solana continues to dominate as one of the most developer-friendly blockchains.

🔍 Why It Could Boom:

- ETF momentum: A potential Solana ETF could flood the market with institutional capital.

- Insane throughput: 65,000+ TPS and millisecond finality.

- Massive developer base: From Web3 games to DeFi apps, Solana is a builder’s playground.

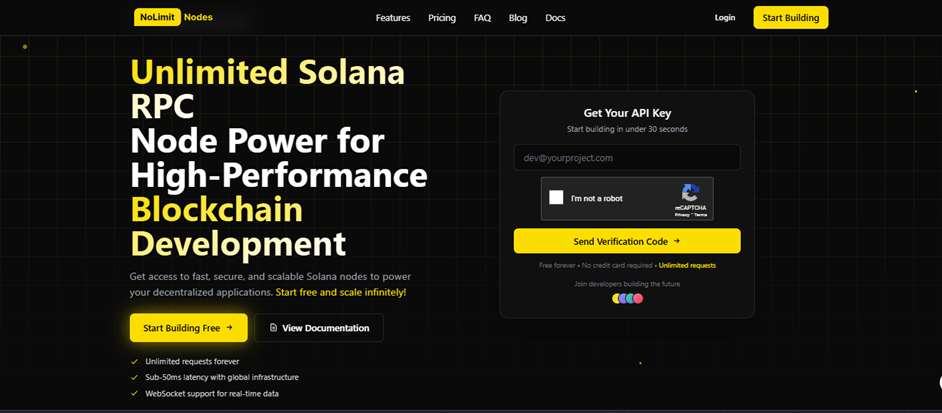

⚙️ How NoLimitNodes Powers Solana Builders:

With Solana’s scale, developers need stable, high-throughput RPC endpoints to keep up with traffic. That’s where NoLimitNodes comes in.

Our managed Solana RPC infrastructure offers:

- Global low-latency RPC URLs

- Secure WebSocket access

- Fast, reliable historical data querying

- Plug-and-play access with minimal setup

🧪 Want to launch your Solana dApp today? 🔗 Try NoLimitNodes for Free

🌐 XRP: The Cross-Border Titan

XRP, created by Ripple Labs, has long been positioned as the go-to solution for cross-border payments. With its blazing fast settlement time (3–5 seconds) and negligible fees, XRP was designed for banks and financial institutions.

🔍 Why It Could Boom:

- Legal clarity: With the SEC lawsuit largely behind it, XRP is re-entering major U.S. exchanges.

- Institutional traction: RippleNet continues to expand globally, onboarding financial players.

- CBDC potential: Ripple is working with central banks to create blockchain-based digital currencies.

🏦 Compound: DeFi's Lending Powerhouse

Compound (COMP) is a decentralized protocol for lending and borrowing crypto. It helped define DeFi 1.0, and despite market cycles, it remains a staple in the decentralized finance ecosystem.

🔍 Why It Could Boom:

- Integration with TradFi tools: Compound is becoming more modular and enterprise-friendly.

- Compound III: Its upgraded protocol supports cross-chain deployments and improved collateral efficiency.

- Stable revenue: With lending markets expanding, Compound earns protocol fees even during bear markets.

Compound runs on Ethereum, which means developers still face congestion and gas issues—but those building data dashboards, yield aggregators, or governance apps still need fast, reliable Ethereum access.

⚙️ Ethereum RPC via NoLimitNodes:

NoLimitNodes supports Ethereum JSON-RPC and WebSocket endpoints, making it easy to:

- Track on-chain lending activity

- Build DeFi dashboards

- Monitor governance proposals in real time

🔌 Explore Ethereum RPC Access →

🧠 Final Thoughts: What Ties Them All Together?

While XRP, Solana, and Compound differ in design and audience, they share a common theme:

They enable real-world applications.

And behind every real-world crypto use case is infrastructure—nodes, RPC endpoints, and developer tools that make those apps reliable and fast.

That’s where NoLimitNodes stands out.

Whether you're analyzing yield curves on Compound, minting NFTs on Solana, or preparing to interact with an XRP-based payment API—you need reliable, global RPC access to build without friction.

🔗 Start Building Smarter with NoLimitNodes

With NoLimitNodes, you don’t need to worry about node setup, scalability issues, or downtime. Just plug in and build.

✅ Scalable RPC access

✅ Multi-chain support (Solana, Ethereum, more coming soon)

✅ Real-time analytics, logs, and monitoring